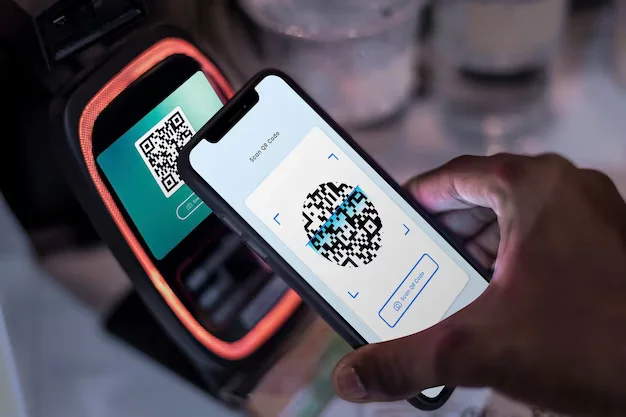

In today’s increasingly digital world, the importance of cybersecurity in digital payments cannot be overstated. As technology advances, more and more financial transactions are being conducted online and on mobile devices. While this facility changed the way we manage our finances, it also opened the door to cyber threats and vulnerabilities that could threaten our financial security.

First and foremost, cybersecurity is essential to protect sensitive personal and financial information. When we make digital payments, we often provide information such as credit card numbers, bank account information, and even our social security numbers. If this information gets into the wrong hands, it can be used for identity theft, fraud, or unauthorized purposes. Strong cybersecurity measures, including encryption and multi-factor authentication, help protect this information from cybercriminals.

Furthermore, the global nature of digital payments makes them vulnerable to international cyber threats. Cyberattacks can come from anywhere in the world, so it is important that payment systems have robust security measures in place to protect against these threats A single breach can take its toll later, affecting not only individuals but also corporations and governments.

In conclusion, the importance of cybersecurity in digital payments cannot be underestimated. It protects our sensitive information, ensures the reliability of payment systems, and protects us from international cyber threats. As we continue to embrace the convenience of digital payments, investing in cybersecurity infrastructure is not just an option; We must safeguard the future of our economy and safeguard the integrity of the digital economy