Optimizing your website for international payments is essential to expand your online business globally. For starters, it’s important to offer multiple currency support, allowing customers to pay in their preferred currency. Additionally, local payment methods, such as credit card, PayPal, and digital wallet offerings cater to payment preferences across businesses

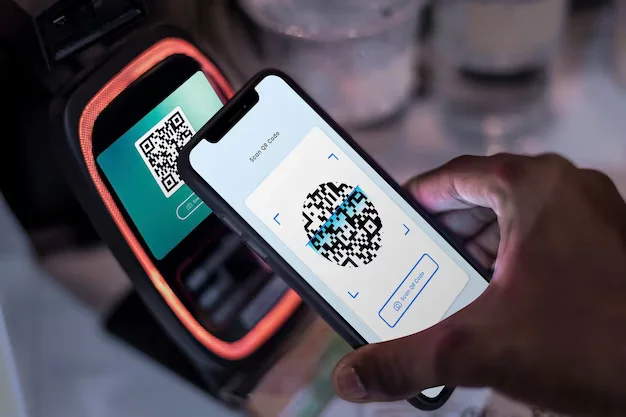

Creating a seamless user experience is equally important. Considering how much you use mobile devices for online shopping, translate your website content into the languages of your target market and make sure your payment process is suitable for mobile. Transparent pricing in local currencies and real-time currency exchange tools increase transparency and help international buyers make informed purchasing decisions.

Complying with international payment regulations including tax laws, GDPR, and other data privacy laws is essential to ensure trust and avoid legal issues Furthermore, shipping a variety of products, information transparent shipping, and multilingual customer support, contribute to a better shopping experience for international customers.

Invest in a secure payment gateway that can handle international transactions securely, protecting customer data and financial transactions. Optimize your website based on customer feedback and data analytics, and regularly test your international payment systems to identify and resolve any issues.

Keep an eye on international markets, understand changing preferences, regulations and competitors, and adjust your payment terms accordingly. Display trust signals such as SSL certificates, acceptable payment tokens, and customer reviews to build confidence in your website’s reliability among international customers.

In conclusion, by using these strategies, you can optimize your website for international payments and reach a global customer base, ultimately increasing the success of your online business in the whole world.