In today’s rapidly evolving e-commerce world, Payment Gateways services have become a critical element for businesses that want to succeed online. These services function as intermediaries between merchants and customers, facilitating secure online transactions by encrypting sensitive financial data. By doing so, they ensure that transactions are protected from cyber threats and fraud while offering a smooth, convenient process for customers. This ability to securely handle payment information is a key factor in helping businesses expand their reach, improve sales, and build lasting customer loyalty.

How Payment Gateways Services Work: A Simplified Process

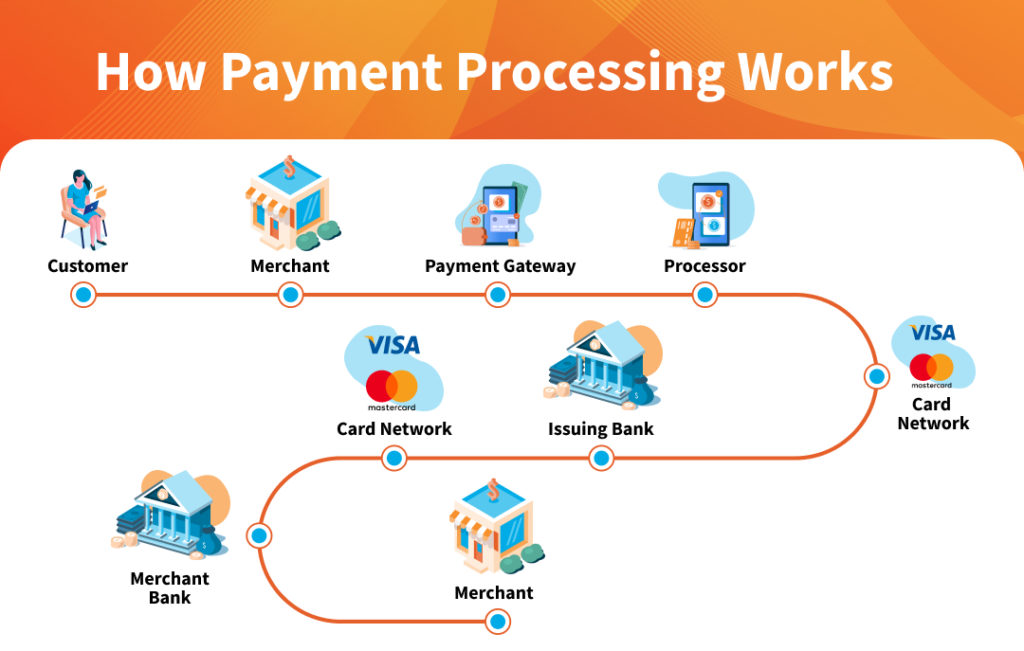

While the process behind Payment Gateway services may sound complex, it is designed to be straightforward and efficient. The process starts when a customer chooses a product, adds it to their cart, and proceeds to checkout. At this point, the payment gateway encrypts the customer’s payment details such as credit card information, bank details, and other sensitive data to ensure security during the transaction.

Once encrypted, the data is sent to the acquiring bank (the merchant’s bank) for authorization. The bank checks whether the payment details are valid and whether the customer has sufficient funds. If everything checks out, the transaction is approved. The payment gateway then transfers the funds to the merchant’s account, completing the sale. All of this happens in a matter of seconds, providing customers with a seamless and speedy transaction experience.

The Benefits of Using Payment Gateways Services

Enhanced Security for Businesses and Customers

For businesses, Payment Gateway services reduce the risk of fraud by providing secure transaction channels. They enable encryption, tokenization, and compliance with global security standards like PCI-DSS (Payment Card Industry Data Security Standard). This ensures that sensitive customer information is kept secure, minimizing the chances of data breaches or unauthorized transactions.

Global Reach and Multi-Currency Support

In addition to ensuring security, Payment Gateways offer businesses the ability to support a wide range of payment methods and currencies. This opens up the opportunity for global sales, allowing businesses to cater to customers across different countries and regions. Whether it’s local or international transactions, Payment Gateways can handle multiple currencies and international payment methods, broadening the customer base for businesses.

Seamless Customer Experience

For customers, the benefit of using a Payment Gateway lies in the seamless and hassle-free checkout experience. With easy integration, customers can make payments using a variety of methods, including credit/debit cards, net banking, e-wallets, and even cryptocurrency in some cases. This variety of payment options builds trust and confidence among customers, encouraging repeat purchases and fostering long-term brand loyalty.

Faster Transactions and Increased Sales

With the convenience of online payments, businesses see an improvement in their conversion rates. Payment Gateways streamline the checkout process by reducing the steps needed to complete a transaction, which leads to fewer abandoned carts and more successful sales. Additionally, the speed of online payments helps to boost customer satisfaction by offering a quick and easy purchasing experience.

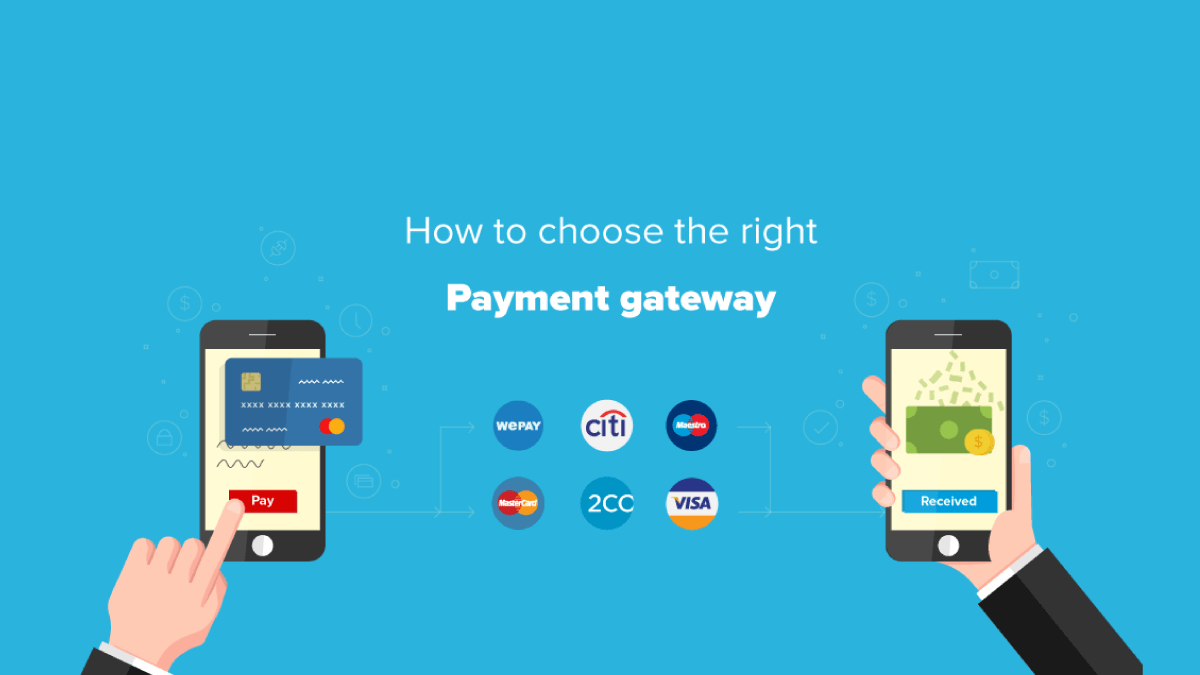

Choosing the Right Payment Gateway Service: Key Factors to Consider

When it comes to selecting a Payment Gateway, businesses need to carefully consider several factors to ensure they choose the best one for their needs:

Security and Compliance

Above all, security is the most critical factor to consider. A reliable Payment Gateway should comply with industry standards such as PCI-DSS to ensure the safety of customer data. Look for services that offer advanced encryption techniques, tokenization, and two-factor authentication to minimize the risk of fraud.

Transaction Fees and Cost Structure

Every Payment Gateway service has a fee structure, including transaction fees, setup costs, and monthly maintenance charges. It is essential to understand these costs to determine whether the service is affordable for your business. Compare different gateways to find the one that offers the best value for your transaction volume.

Integration with Your Platform

Ensure that the Payment Gateway integrates seamlessly with your e-commerce platform, whether it’s a website, mobile app, or a third-party marketplace. Many modern gateways offer easy integration with popular platforms such as Shopify, WooCommerce, Magento, and others. A smooth integration ensures a seamless experience for both merchants and customers.

Customer Support and Service Availability

Having reliable customer support is vital. Choose a Payment Gateway provider that offers 24/7 customer support and quick response times. This ensures that any issues related to payments or transactions can be resolved quickly, minimizing disruptions in your business operations.

Major Trends in Payment Gateway Services: What’s Shaping the Future?

As digital payments continue to evolve, several key trends are shaping the future of Payment Gateway services. These innovations are improving security, convenience, and efficiency, while also offering new opportunities for businesses.

1. Biometric Authentication for Enhanced Security

One of the emerging trends is the use of biometric authentication in payment gateways. Fingerprint scanning, facial recognition, and voice recognition are becoming popular methods for securing transactions. These biometric technologies help ensure that only authorized users can make payments, significantly reducing fraud and identity theft.

2. Artificial Intelligence (AI) and Machine Learning (ML) in Fraud Prevention

AI and ML are playing a key role in improving the security of digital payments. These technologies can analyze transaction patterns in real time, allowing them to detect and prevent fraudulent activities before they occur. Machine learning algorithms continually improve, making payment systems more intelligent and capable of identifying threats proactively.

3. Cryptocurrencies and Blockchain Integration

With the growing popularity of cryptocurrencies, Payment Gateways are starting to integrate digital currencies such as Bitcoin, Ethereum, and others as payment options. This allows businesses to tap into new markets, especially among tech-savvy customers who prefer to use cryptocurrencies for their purchases. Additionally, blockchain technology offers transparent and secure transactions, further enhancing the reliability of digital payments.

4. Mobile Payment Solutions and PWAs

As smartphones become the primary device for online shopping, mobile-first payment solutions are gaining importance. Payment Gateways are optimizing their platforms for mobile devices, offering features like one-click payments, mobile wallets, and integrated mobile apps. Progressive Web Apps (PWAs) are also emerging as a way to provide a seamless, app-like experience on mobile browsers.

Adapting to a Mobile-First World: Meeting Consumer Expectations

The shift to mobile-first is a significant trend in the digital payment space. With the increasing number of people shopping via smartphones, Payment Gateways are enhancing their platforms to be mobile-friendly. Features such as one-click payments, mobile wallet integrations (like Google Pay and Apple Pay), and optimized checkout processes are becoming essential for businesses to remain competitive in a mobile-first world.

Conclusion: The Future of Payment Gateway Services

Payment Gateway services are integral to the success of e-commerce businesses. They provide the security and convenience that both businesses and customers require for seamless online transactions. As the digital payment landscape continues to evolve, staying informed about emerging trends—such as biometric authentication, AI-powered fraud detection, and mobile payment solutions—can help businesses maintain a competitive edge.

By understanding the functionality, benefits, and trends in Payment Gateway services, businesses can make informed decisions that enhance their payment systems, boost customer satisfaction, and drive long-term growth.