India’s digital payment landscape has been undergoing a significant transformation over the past few years. Spearheaded by advances in fintech, supportive government policies, and a strong push for financial inclusion, the payment gateway ecosystem in India has emerged as a global leader in digital innovation. Here are some of the most important trends influencing Indian payment gateways today:

Unified Payments Interface (UPI) Dominance

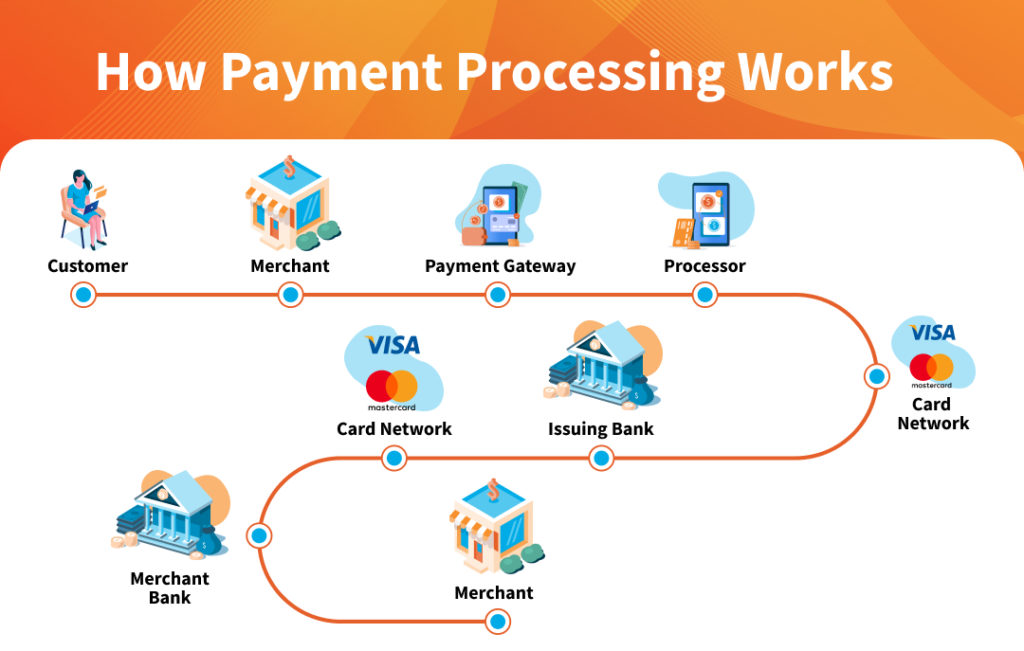

UPI: The Cornerstone of India’s Digital Payments: Introduced by the National Payments Corporation of India (NPCI), UPI enables fast, secure, and seamless transactions between bank accounts and is accessible through various apps. Its ease of use, zero-cost model, and accessibility have made UPI a favorite, with transactions surpassing 10 billion monthly.

Cross-Border Expansion: India’s UPI model has also sparked interest globally, with countries like Singapore, the UAE, and Nepal adopting similar models or allowing UPI-based payments for Indian travelers, increasing convenience for Indians abroad.

Impact on Business Ecosystem: UPI’s popularity has pushed businesses of all sizes, from mom-and-pop stores to large enterprises, to adopt this payment method, making UPI a driving force behind India’s shift towards digital payments.

Government Initiatives and Regulatory Support

Push for a Digital Economy: Through initiatives like Digital India, Pradhan Mantri Jan Dhan Yojana (PMJDY), and Pradhan Mantri Gramin Digital Saksharta Abhiyan, the government has accelerated financial inclusion, digital literacy, and technology access in rural areas.

RBI’s Role in Security and Compliance: The Reserve Bank of India has introduced several measures to ensure safety and compliance within the digital payment space, including tokenization for card data protection, data localization to safeguard user information, and frameworks around digital lending to prevent predatory practices.

Promotion of Zero MDR for UPI and RuPay: To promote digital transactions, the government has enforced a zero MDR (Merchant Discount Rate) on UPI and RuPay transactions, reducing transaction fees for businesses and boosting the adoption of digital payments.

Growth of Contactless Payments

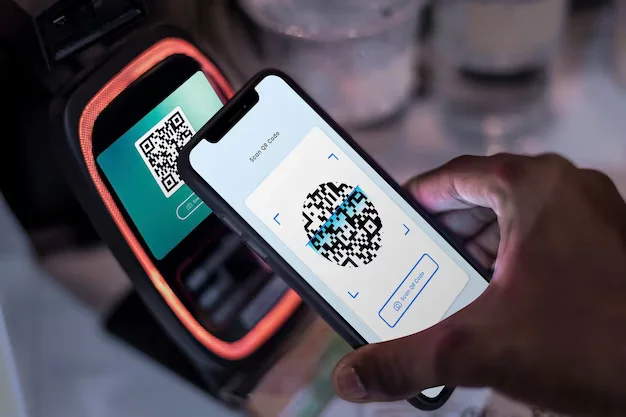

Pandemic-Driven Adoption of Contactless Solutions: With COVID-19, consumers and businesses rapidly transitioned to contactless payment options. QR code payments, tap-and-go cards, and NFC-enabled devices became essential for reducing physical contact and enhancing safety.

QR Codes and Bharat QR Innovations: Payment gateway providers have embraced QR code payments, making it cost-effective and easy for businesses of all sizes to accept digital payments. Bharat QR, India’s first interoperable QR code payment solution, allows customers to pay using any payment app or bank account, expanding contactless accessibility.

Evolving Contactless Infrastructure: The integration of NFC (Near Field Communication) and digital wallets like Google Pay and Apple Pay has further strengthened the contactless ecosystem, making digital payments convenient and mainstream.

The Rise of Buy Now, Pay Later (BNPL) and Consumer Credit Options

BNPL as a Consumer Credit Solution: Buy Now, Pay Later has gained significant traction, offering users the flexibility to pay in installments, which has helped increase spending and improve customer satisfaction. Platforms like Simpl, LazyPay, and ZestMoney have integrated BNPL within their payment gateway frameworks, particularly benefiting millennials and Gen Z consumers.

Broadening BNPL into New Sectors: Initially popular in the e-commerce space, BNPL has extended to sectors such as healthcare, travel, and education, offering easy access to credit for a broader range of needs. Payment gateways are now supporting BNPL for services and experiences beyond retail.

Artificial Intelligence and Machine Learning for Security and Personalization

AI for Fraud Detection and Prevention: Payment gateways are leveraging AI and ML to identify and combat fraud in real-time. These technologies monitor and analyze transactional patterns, flagging any unusual activities that may indicate fraud.

Enhanced User Personalization: Beyond security, AI is enhancing user experience. By studying transaction behavior, payment gateways can offer personalized recommendations, promotions, and offers, which improve user engagement and loyalty.

KYC and AML Advancements: AI and ML have also improved Know Your Customer (KYC) and Anti-Money Laundering (AML) processes, making it easier for users to complete onboarding quickly and securely.

Cross-Border Payment Solutions and Blockchain Integration

Growing Need for Efficient Cross-Border Payments: With a rise in freelancers, startups, and businesses engaging in international trade, the demand for reliable cross-border payments has grown significantly. Payment gateways are optimizing these transactions for faster processing and lower fees, benefiting the gig economy and exporters.

Exploring Blockchain for Transparency: Some payment gateways are exploring Blockchain solutions to enhance transparency, security, and cost efficiency in cross-border transactions. Blockchain offers immutable ledgers and near-instant transactions, making it ideal for high-value or frequent international payments.

Embedded Finance and Digital Lending Integrations

Seamless Access to Credit: Payment gateways now offer integrated access to digital lending products, such as small business loans and personal credit lines, creating an embedded finance experience. This trend benefits consumers by providing credit seamlessly during checkout or transaction processes.

Alternative Credit Scoring Models: With traditional credit checks often leaving out a large segment of the population, digital lending models have adopted alternative data sources to score users. Leveraging digital footprints and transactional history, these models enable payment gateways to offer loans and credit facilities with improved accuracy and inclusivity.

Emphasis on Data Privacy, Security, and Compliance

Data Localization and Compliance with RBI Norms: With India’s new data localization laws, payment providers are required to store transaction data locally, safeguarding Indian consumers’ information and ensuring compliance with local regulations.

Tokenization and End-to-End Encryption: Tokenization replaces sensitive card information with unique identifiers (tokens) to keep data secure during transactions. End-to-end encryption further ensures that sensitive information is secure from potential breaches, enhancing consumer trust.

Stricter Guidelines on Digital Lending: As the popularity of digital lending increases, the RBI has implemented guidelines to protect consumers from exploitative practices. These regulations ensure transparent fees, fair interest rates, and clear communication with borrowers.

The digital payment ecosystem in India is fast-evolving, fueled by technological advancements, regulatory support, and consumer demands for fast, secure, and convenient payment solutions. Payment gateways play a critical role, serving as the backbone for these transformations. By harnessing the power of AI, adopting innovative payment models like BNPL, and staying compliant with regulatory frameworks, India’s payment gateway providers are helping lead the global shift towards a cashless and connected economy. The coming years will likely bring even more changes, as technology advances and digital financial services become ever more integral to everyday life in India.

India’s digital payment landscape has been undergoing a significant transformation over the past few years. Spearheaded by advances in fintech, supportive government policies, and a strong push for financial inclusion, the payment gateway ecosystem in India has emerged as a global leader in digital innovation. Here are some of the most important trends influencing Indian payment gateways today:

Unified Payments Interface (UPI) Dominance

UPI: The Cornerstone of India’s Digital Payments: Introduced by the National Payments Corporation of India (NPCI), UPI enables fast, secure, and seamless transactions between bank accounts and is accessible through various apps. Its ease of use, zero-cost model, and accessibility have made UPI a favorite, with transactions surpassing 10 billion monthly.

Cross-Border Expansion: India’s UPI model has also sparked interest globally, with countries like Singapore, the UAE, and Nepal adopting similar models or allowing UPI-based payments for Indian travelers, increasing convenience for Indians abroad.

Impact on Business Ecosystem: UPI’s popularity has pushed businesses of all sizes, from mom-and-pop stores to large enterprises, to adopt this payment method, making UPI a driving force behind India’s shift towards digital payments.

Government Initiatives and Regulatory Support

Push for a Digital Economy: Through initiatives like Digital India, Pradhan Mantri Jan Dhan Yojana (PMJDY), and Pradhan Mantri Gramin Digital Saksharta Abhiyan, the government has accelerated financial inclusion, digital literacy, and technology access in rural areas.

RBI’s Role in Security and Compliance: The Reserve Bank of India has introduced several measures to ensure safety and compliance within the digital payment space, including tokenization for card data protection, data localization to safeguard user information, and frameworks around digital lending to prevent predatory practices.

Promotion of Zero MDR for UPI and RuPay: To promote digital transactions, the government has enforced a zero MDR (Merchant Discount Rate) on UPI and RuPay transactions, reducing transaction fees for businesses and boosting the adoption of digital payments.

Growth of Contactless Payments

Pandemic-Driven Adoption of Contactless Solutions: With COVID-19, consumers and businesses rapidly transitioned to contactless payment options. QR code payments, tap-and-go cards, and NFC-enabled devices became essential for reducing physical contact and enhancing safety.

QR Codes and Bharat QR Innovations: Payment gateway providers have embraced QR code payments, making it cost-effective and easy for businesses of all sizes to accept digital payments. Bharat QR, India’s first interoperable QR code payment solution, allows customers to pay using any payment app or bank account, expanding contactless accessibility.

Evolving Contactless Infrastructure: The integration of NFC (Near Field Communication) and digital wallets like Google Pay and Apple Pay has further strengthened the contactless ecosystem, making digital payments convenient and mainstream.

The Rise of Buy Now, Pay Later (BNPL) and Consumer Credit Options

BNPL as a Consumer Credit Solution: Buy Now, Pay Later has gained significant traction, offering users the flexibility to pay in installments, which has helped increase spending and improve customer satisfaction. Platforms like Simpl, LazyPay, and ZestMoney have integrated BNPL within their payment gateway frameworks, particularly benefiting millennials and Gen Z consumers.

Broadening BNPL into New Sectors: Initially popular in the e-commerce space, BNPL has extended to sectors such as healthcare, travel, and education, offering easy access to credit for a broader range of needs. Payment gateways are now supporting BNPL for services and experiences beyond retail.

Artificial Intelligence and Machine Learning for Security and Personalization

AI for Fraud Detection and Prevention: Payment gateways are leveraging AI and ML to identify and combat fraud in real-time. These technologies monitor and analyze transactional patterns, flagging any unusual activities that may indicate fraud.

Enhanced User Personalization: Beyond security, AI is enhancing user experience. By studying transaction behavior, payment gateways can offer personalized recommendations, promotions, and offers, which improve user engagement and loyalty.

KYC and AML Advancements: AI and ML have also improved Know Your Customer (KYC) and Anti-Money Laundering (AML) processes, making it easier for users to complete onboarding quickly and securely.

Cross-Border Payment Solutions and Blockchain Integration

Growing Need for Efficient Cross-Border Payments: With a rise in freelancers, startups, and businesses engaging in international trade, the demand for reliable cross-border payments has grown significantly. Payment gateways are optimizing these transactions for faster processing and lower fees, benefiting the gig economy and exporters.

Exploring Blockchain for Transparency: Some payment gateways are exploring Blockchain solutions to enhance transparency, security, and cost efficiency in cross-border transactions. Blockchain offers immutable ledgers and near-instant transactions, making it ideal for high-value or frequent international payments.

Embedded Finance and Digital Lending Integrations

Seamless Access to Credit: Payment gateways now offer integrated access to digital lending products, such as small business loans and personal credit lines, creating an embedded finance experience. This trend benefits consumers by providing credit seamlessly during checkout or transaction processes.

Alternative Credit Scoring Models: With traditional credit checks often leaving out a large segment of the population, digital lending models have adopted alternative data sources to score users. Leveraging digital footprints and transactional history, these models enable payment gateways to offer loans and credit facilities with improved accuracy and inclusivity.

Emphasis on Data Privacy, Security, and Compliance

Data Localization and Compliance with RBI Norms: With India’s new data localization laws, payment providers are required to store transaction data locally, safeguarding Indian consumers’ information and ensuring compliance with local regulations.

Tokenization and End-to-End Encryption: Tokenization replaces sensitive card information with unique identifiers (tokens) to keep data secure during transactions. End-to-end encryption further ensures that sensitive information is secure from potential breaches, enhancing consumer trust.

Stricter Guidelines on Digital Lending: As the popularity of digital lending increases, the RBI has implemented guidelines to protect consumers from exploitative practices. These regulations ensure transparent fees, fair interest rates, and clear communication with borrowers.

The digital payment ecosystem in India is fast-evolving, fueled by technological advancements, regulatory support, and consumer demands for fast, secure, and convenient payment solutions. Payment gateways play a critical role, serving as the backbone for these transformations. By harnessing the power of AI, adopting innovative payment models like BNPL, and staying compliant with regulatory frameworks, India’s payment gateway providers are helping lead the global shift towards a cashless and connected economy. The coming years will likely bring even more changes, as technology advances and digital financial services become ever more integral to everyday life in India.

India’s digital payment landscape has been undergoing a significant transformation over the past few years. Spearheaded by advances in fintech, supportive government policies, and a strong push for financial inclusion, the payment gateway ecosystem in India has emerged as a global leader in digital innovation. Here are some of the most important trends influencing Indian payment gateways today:

Unified Payments Interface (UPI) Dominance

UPI: The Cornerstone of India’s Digital Payments: Introduced by the National Payments Corporation of India (NPCI), UPI enables fast, secure, and seamless transactions between bank accounts and is accessible through various apps. Its ease of use, zero-cost model, and accessibility have made UPI a favorite, with transactions surpassing 10 billion monthly.

Cross-Border Expansion: India’s UPI model has also sparked interest globally, with countries like Singapore, the UAE, and Nepal adopting similar models or allowing UPI-based payments for Indian travelers, increasing convenience for Indians abroad.

Impact on Business Ecosystem: UPI’s popularity has pushed businesses of all sizes, from mom-and-pop stores to large enterprises, to adopt this payment method, making UPI a driving force behind India’s shift towards digital payments.

Government Initiatives and Regulatory Support

Push for a Digital Economy: Through initiatives like Digital India, Pradhan Mantri Jan Dhan Yojana (PMJDY), and Pradhan Mantri Gramin Digital Saksharta Abhiyan, the government has accelerated financial inclusion, digital literacy, and technology access in rural areas.

RBI’s Role in Security and Compliance: The Reserve Bank of India has introduced several measures to ensure safety and compliance within the digital payment space, including tokenization for card data protection, data localization to safeguard user information, and frameworks around digital lending to prevent predatory practices.

Promotion of Zero MDR for UPI and RuPay: To promote digital transactions, the government has enforced a zero MDR (Merchant Discount Rate) on UPI and RuPay transactions, reducing transaction fees for businesses and boosting the adoption of digital payments.

Growth of Contactless Payments

Pandemic-Driven Adoption of Contactless Solutions: With COVID-19, consumers and businesses rapidly transitioned to contactless payment options. QR code payments, tap-and-go cards, and NFC-enabled devices became essential for reducing physical contact and enhancing safety.

QR Codes and Bharat QR Innovations: Payment gateway providers have embraced QR code payments, making it cost-effective and easy for businesses of all sizes to accept digital payments. Bharat QR, India’s first interoperable QR code payment solution, allows customers to pay using any payment app or bank account, expanding contactless accessibility.

Evolving Contactless Infrastructure: The integration of NFC (Near Field Communication) and digital wallets like Google Pay and Apple Pay has further strengthened the contactless ecosystem, making digital payments convenient and mainstream.

The Rise of Buy Now, Pay Later (BNPL) and Consumer Credit Options

BNPL as a Consumer Credit Solution: Buy Now, Pay Later has gained significant traction, offering users the flexibility to pay in installments, which has helped increase spending and improve customer satisfaction. Platforms like Simpl, LazyPay, and ZestMoney have integrated BNPL within their payment gateway frameworks, particularly benefiting millennials and Gen Z consumers.

Broadening BNPL into New Sectors: Initially popular in the e-commerce space, BNPL has extended to sectors such as healthcare, travel, and education, offering easy access to credit for a broader range of needs. Payment gateways are now supporting BNPL for services and experiences beyond retail.

Artificial Intelligence and Machine Learning for Security and Personalization

AI for Fraud Detection and Prevention: Payment gateways are leveraging AI and ML to identify and combat fraud in real time. These technologies monitor and analyze transactional patterns, flagging any unusual activities that may indicate fraud.

Enhanced User Personalization: Beyond security, AI is enhancing user experience. By studying transaction behavior, payment gateways can offer personalized recommendations, promotions, and offers, which improve user engagement and loyalty.

KYC and AML Advancements: AI and ML have also improved Know Your Customer (KYC) and Anti-Money Laundering (AML) processes, making it easier for users to complete onboarding quickly and securely.

Cross-Border Payment Solutions and Blockchain Integration

Growing Need for Efficient Cross-Border Payments: With a rise in freelancers, startups, and businesses engaging in international trade, the demand for reliable cross-border payments has grown significantly. Payment gateways are optimizing these transactions for faster processing and lower fees, benefiting the gig economy and exporters.

Exploring Blockchain for Transparency: Some payment gateways are exploring Blockchain solutions to enhance transparency, security, and cost efficiency in cross-border transactions. Blockchain offers immutable ledgers and near-instant transactions, making it ideal for high-value or frequent international payments.

Embedded Finance and Digital Lending Integrations

Seamless Access to Credit: Payment gateways now offer integrated access to digital lending products, such as small business loans and personal credit lines, creating an embedded finance experience. This trend benefits consumers by providing credit seamlessly during checkout or transaction processes.

Alternative Credit Scoring Models: With traditional credit checks often leaving out a large segment of the population, digital lending models have adopted alternative data sources to score users. Leveraging digital footprints and transactional history, these models enable payment gateways to offer loans and credit facilities with improved accuracy and inclusivity.

Emphasis on Data Privacy, Security, and Compliance

Data Localization and Compliance with RBI Norms: With India’s new data localization laws, payment providers are required to store transaction data locally, safeguarding Indian consumers’ information and ensuring compliance with local regulations.

Tokenization and End-to-End Encryption: Tokenization replaces sensitive card information with unique identifiers (tokens) to keep data secure during transactions. End-to-end encryption further ensures that sensitive information is secure from potential breaches, enhancing consumer trust.

Stricter Guidelines on Digital Lending: As the popularity of digital lending increases, the RBI has implemented guidelines to protect consumers from exploitative practices. These regulations ensure transparent fees, fair interest rates, and clear communication with borrowers.

The digital payment ecosystem in India is fast-evolving, fueled by technological advancements, regulatory support, and consumer demands for fast, secure, and convenient payment solutions. Payment gateways play a critical role, serving as the backbone for these transformations. By harnessing the power of AI, adopting innovative payment models like BNPL, and staying compliant with regulatory frameworks, India’s payment gateway providers are helping lead the global shift towards a cashless and connected economy. The coming years will likely bring even more changes, as technology advances and digital financial services become ever more integral to everyday life in India.