Introduction

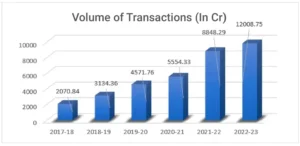

In today’s world, where digital payments are becoming the norm, payment gateways are an essential tool for businesses. Whether you are running an online store, providing services, or operating a physical shop, having the right payment gateway helps make customer transactions smooth and secure.

In India, three of the most popular payment gateways are Razorpay, Paytm, and PayU. Each of these options comes with its own set of features, benefits, and pricing, making it important to understand which one is best suited for your business.

This guide will explain the differences between these payment gateways and help you make an informed decision. For expert advice, you can always rely on Digitalpaymentguru.com, a trusted platform that assists businesses in finding the perfect payment gateway.

What is a Payment Gateway?

A payment gateway is a technology that helps businesses accept payments online or digitally. It ensures that transactions are processed securely, connecting the customer’s payment method (like a debit card, credit card, UPI, or wallet) to the business’s bank account.

Why Do You Need a Payment Gateway?

You need a payment gateway for several reasons. It allows customers to make online payments conveniently, ensures that transactions are safe and secure, and supports multiple payment methods such as UPI, wallets, and cards. Additionally, having a payment gateway enables your business to expand its reach by accepting cross-border transactions.

A Quick Overview of Razorpay, Paytm, and PayU?

Before diving into the details, let’s briefly understand what each payment gateway offers. Razorpay is highly regarded for its ease of integration and advanced features, making it suitable for startups and subscription-based businesses. Paytm is known for its simple setup and strong wallet integration, making it a favorite among small businesses and offline retailers. PayU stands out for its flexibility, global payment support, and advanced fraud prevention features, making it ideal for e-commerce platforms and businesses with high transaction volumes.

Razorpay: A Feature-Rich Gateway

Razorpay is one of India’s most widely used payment gateways. It is known for its powerful features that cater to startups, small businesses, and large enterprises. It supports a wide range of payment methods, including UPI, cards, net banking, and wallets.

What Makes Razorpay Stand Out?

Razorpay stands out because of its robust functionality. It offers subscription management, which is great for businesses that need recurring billing. The instant settlement ensures that businesses receive funds quickly. Additionally, it supports international payments and provides developer-friendly APIs for businesses needing custom integration.

Who Should Use Razorpay?

Razorpay is ideal for startups and small businesses looking for an all-in-one solution. E-commerce stores with complex payment needs and subscription-based businesses also benefit greatly from its features.

Pricing of Razorpay

Razorpay has no setup fees. Its transaction charges start at 2% for domestic payments and 3% for international payments.

Paytm Payment Gateway: Great for Local Businesses

Paytm is a household name in India. Apart from its wallet service, it offers a robust payment gateway that is simple and cost-effective for businesses. Its QR code system makes it especially popular among physical stores and local retailers.

Why Choose Paytm?

Paytm is an excellent choice for businesses targeting Indian customers. It supports UPI, wallets, cards, and EMI payments, offering businesses a wide variety of payment methods. The Paytm Wallet integration allows businesses to tap into its large user base. Additionally, its QR code feature is perfect for businesses accepting offline payments.

Who Should Use Paytm?

Paytm is best suited for small and medium-sized businesses, retail stores that accept both online and offline payments, and businesses targeting Indian customers who rely on wallet and UPI payments.

Pricing of Paytm

Paytm charges no setup fees. Its transaction charges start at 1.75% for UPI and wallet payments and 2% for card transactions.

PayU India: A Flexible Option

PayU India is known for its wide range of features and global payment capabilities. It supports over 150 payment options and is widely used by e-commerce platforms and subscription-based services.

What Makes PayU Special?

PayU is a great choice for businesses that need flexibility and global payment options. It supports payments in multiple currencies, making it an excellent option for businesses with international clients. PayU also offers one-click checkout, providing customers with a smoother experience. Its fraud prevention tools ensure the security of transactions, while customizable payment pages let businesses maintain consistent branding.

Who Should Use PayU?

PayU is a strong option for businesses with international customers, e-commerce platforms looking for high customization, and companies with high transaction volumes.

Pricing of PayU

PayU charges no setup fees. Its transaction fees start at 2% for domestic payments and 3% for international transactions.

Comparing Razorpay, Paytm, and PayU

When comparing these three payment gateways, Razorpay is best known for its advanced features, such as subscription billing and quick settlements, making it suitable for startups and tech-savvy businesses. Paytm stands out for its strong wallet integration, low costs, and offline QR code support, making it ideal for local businesses. PayU offers global payment support, one-click checkout, and advanced fraud prevention tools, making it perfect for e-commerce platforms and businesses with international customers.

Each gateway has its strengths, so the best choice depends on your business requirements.

How to Choose the Right Payment Gateway for Your Business

To choose the right payment gateway, you should first identify your business’s needs. Ask yourself these questions:

1. What types of payments do I need to accept?

2. Do I need international payment support?

3. What is my budget for transaction fees?

4. Do I need advanced features like recurring billing or API integration?

Based on your answers, you can decide which gateway works best for you. Razorpay is a great choice for subscription-based services, while Paytm is better for small businesses and retail stores. PayU, on the other hand, is ideal for e-commerce platforms and businesses handling global payments.

Why Digitalpaymentguru.com is Your Best Partner

Finding the right payment gateway can be overwhelming, but Digitalpaymentguru.com is here to help. They provide expert guidance and comparisons, helping businesses choose the best payment gateway based on their specific needs. From simplifying the integration process to offering ongoing support, Digitalpaymentguru.com ensures that businesses have a seamless experience with their chosen payment gateway.

Conclusion

Razorpay, Paytm, and PayU are three excellent payment gateways for businesses in India. The best choice depends on your business type, target audience, and payment requirements.

For expert guidance and support in choosing and integrating the right payment gateway, rely on Digitalpaymentguru.com to make the process seamless and efficient.

By selecting the right payment gateway, you can ensure a secure, smooth, and convenient payment experience for your customers, helping your business grow in today’s digital economy.