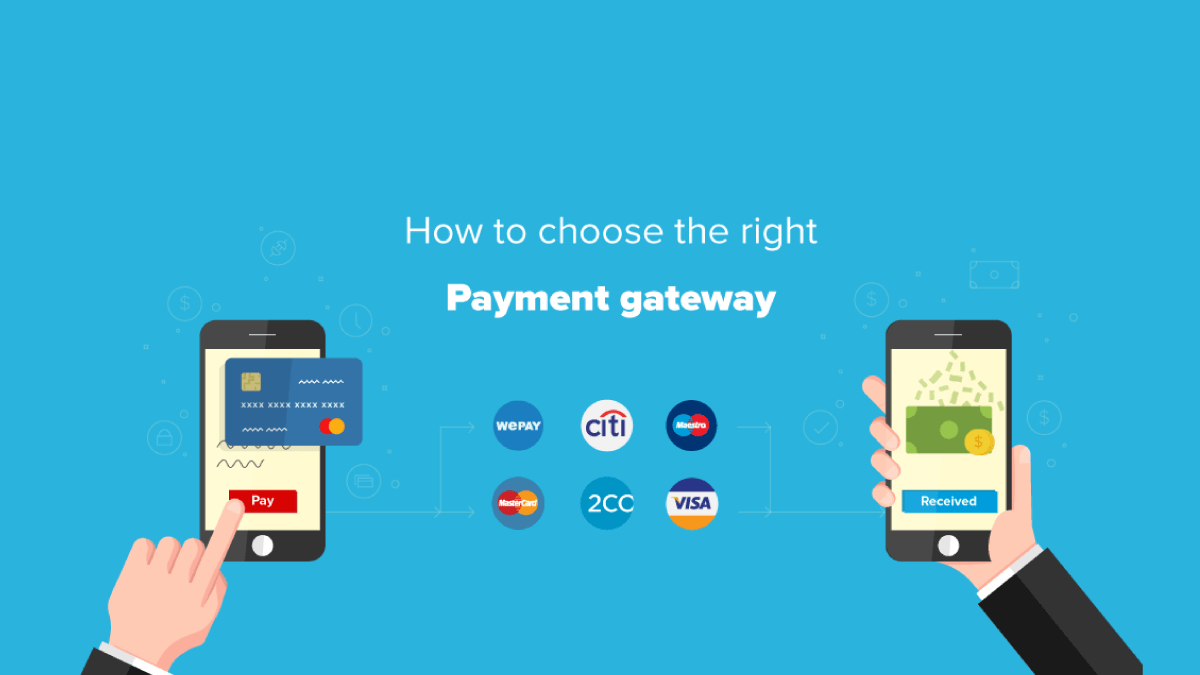

If you run an online business, one of the most important things you need is a smooth and safe way for your customers to pay. This is where a payment gateway comes in. A payment gateway is a tool that helps businesses accept online payments from their customers. It connects your website to the bank so that money can move from your customer’s account to your account securely and quickly.

But choosing the right payment gateway is not just about picking any tool and adding it to your website. You need to think about many things to make sure it works well for your business and your customers. In this article, we will talk about 5 key factors you should consider before integrating a payment gateway. These factors will help you choose a gateway that is secure, easy to use, cost-effective, and reliable.

1. Security and Compliance

When it comes to online payments, security is the most important factor. Your customers are trusting you with their personal and financial information. If your payment system is not safe, it can lead to data theft, fraud, and loss of trust in your business.

That’s why your payment gateway must follow strict security rules. One of the most common standards is called PCI DSS (Payment Card Industry Data Security Standard). It is a set of rules that helps businesses keep cardholder data safe. Make sure the payment gateway you choose is PCI DSS compliant.

Also, look for extra security features like:

- SSL Encryption: It protects the data when it is being transferred from the customer’s device to your server.

- Tokenization: This replaces card details with a random code, so sensitive data is not stored on your website.

- Fraud Detection Tools: Some payment gateways use AI and machine learning to detect fake or suspicious transactions and block them.

By choosing a secure payment gateway, you not only protect your customers but also save your business from legal trouble and financial loss.

2. Payment Methods and Currency Support

Your customers may come from different cities, states, or even countries. They may prefer different ways to pay, depending on where they live and what they’re used to. So, your payment gateway should be flexible and support many types of payment methods.

Here are some common payment methods your gateway should support:

- Credit and debit cards (like Visa, MasterCard, RuPay)

- UPI (Unified Payments Interface)

- Net banking

- Mobile wallets (like Google Pay, PhonePe, Paytm)

- Buy Now, Pay Later (BNPL) services

- EMI payment options

- International payment options for global customers

If your gateway accepts different currencies, it’s even better. For example, if your business wants to expand globally, you must accept payments in dollars, euros, or other currencies. This helps you serve a wider audience and grow your customer base.

Offering multiple payment options and currency support improves the user experience and increases the chance of a successful sale.

3. Ease of Integration and Compatibility

Once you select a payment gateway, the next step is to add it to your website or app. This process is called integration. If the payment gateway is hard to integrate or doesn’t work well with your system, it can waste time and money.

That’s why you should choose a gateway that is easy to set up and works smoothly with your existing e-Commerce platform, website, or mobile app.

Some things to check:

- API and SDK Support: Make sure the payment gateway provides clear API (Application Programming Interface) and SDK (Software Development Kit) documentation for easy integration.

- Plugins for Popular Platforms: If your website is built on platforms like Shopify, WooCommerce, Magento, or WordPress, see if the gateway offers ready-made plugins.

- Customization Options: Some gateways allow you to customize the checkout page so that it looks like your brand. This helps in maintaining a smooth user experience.

- Mobile and Desktop Compatibility: The gateway should work on all devices mobile phones, tablets, and computers.

- Test Environment: Check if the gateway offers a sandbox or testing environment so that you can try out transactions without using real money.

A gateway that is easy to integrate saves time for your developers and gets your payment system up and running faster.

4. Transaction Fees and Pricing Structure

Every payment gateway charges a fee for the services it provides. These charges can include setup fees, monthly charges, and per-transaction fees. Some gateways also charge extra for international payments or currency conversion.

Before you decide on a payment gateway, understand its pricing model properly. Here are some common charges you may come across:

- Setup Fee: Some gateways charge a one-time fee to start using their service.

- Monthly/Annual Maintenance Fee: This is a regular charge for maintaining the gateway.

- Transaction Fee: A small percentage (usually 1.5% to 3%) is taken from every successful payment.

- Currency Conversion Fee: If you accept payments in different currencies, you may be charged for converting the money.

- Chargeback Fee: If a customer disputes a charge, you may be charged a fee for handling the dispute.

Make sure you compare the pricing plans of different payment gateways and choose the one that fits your budget. Also, think about the value you’re getting for the price. Sometimes paying a little more is worth it if the service is better and more reliable.

5. Customer Support and Reliability

Imagine this: It’s a busy day, your website is getting a lot of visitors, and suddenly your payment gateway stops working. Customers can’t pay, and you start losing sales. This is why reliability and customer support are so important.

Your payment gateway should work smoothly, with minimal downtime. You can check reviews and ratings to know how reliable the service is. Look for information on:

- Uptime Guarantee: Does the gateway promise 99.9% uptime or more?

- Speed of Transaction Processing: Is the payment fast and smooth?

- Dispute Resolution Process: How do they handle chargebacks or fraud claims?

Now let’s talk about customer support. Problems can happen at any time, so it’s important to have help available when you need it. Good payment gateways offer 24/7 support through various channels:

- Phone calls

- Live chat

- Ticketing system

It’s also a good idea to check if the gateway has a strong knowledge base, FAQs, and tutorials. This helps you solve small problems on your own without waiting for support.

Choosing a payment gateway with strong support and a good reputation can give you peace of mind and reduce stress when handling payment issues.

Final Thoughts

Adding a payment gateway to your website or app is a big step in building a successful online business. But if you rush into it without thinking carefully, it can lead to problems later. That’s why it’s important to keep these 5 key factors in mind:

- Security and Compliance: Keep customer data safe and follow industry rules.

- Payment Methods and Currency Support: Make it easy for all types of customers to pay.

- Ease of Integration and Compatibility: Save time and effort with a smooth setup.

- Transaction Fees and Pricing: Choose a plan that gives you value for money.

- Customer Support and Reliability: Get help when you need it and reduce the chance of payment failures.

By carefully thinking about these points, you can pick a payment gateway that fits your business needs and helps you grow. A good payment gateway doesn’t just process payments, it builds trust, improves customer satisfaction, and helps you succeed in the online world.