In the high stakes world of global trade, money is now a silent weapon. Specifically, many nations now realize that controlling how funds move is a vital edge. Therefore, building a solid payment infrastructure has become a key tool of soft power. This shift changes how countries talk and trade with each other. It is not just about digital coins or bank apps. In fact, it is a smart way for a country to lead on the global stage. Consequently, a strong and stable payment infrastructure helps a nation project its true strength. You will see a clear shift in power by following this deep and strategic trend.

Winning the Trade War Without a Single Shot

Many people think trade wars are only about high taxes and ships. However, the real fight often happens in the wires and code of a bank. First, a local payment infrastructure can bypass old global rules that slow down growth. Specifically, it lets a country keep its trade moving even when others try to block it. Furthermore, having a top tool that others want to use creates a new kind of bond. You also gain a lead when your neighbors rely on your tech to buy bread. Similarly, a unified payment infrastructure ensures your trade stays safe during a crisis. This puts your growth on a steady path for a very long time.

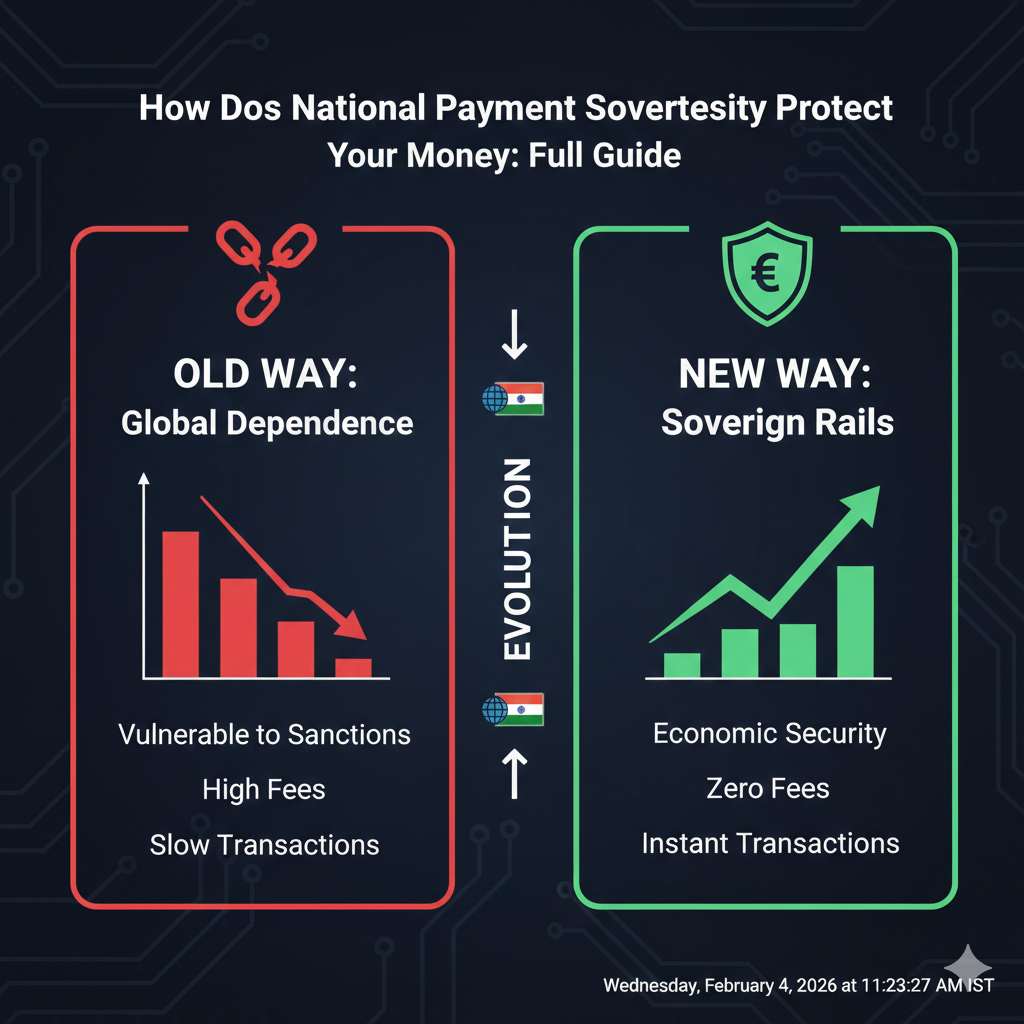

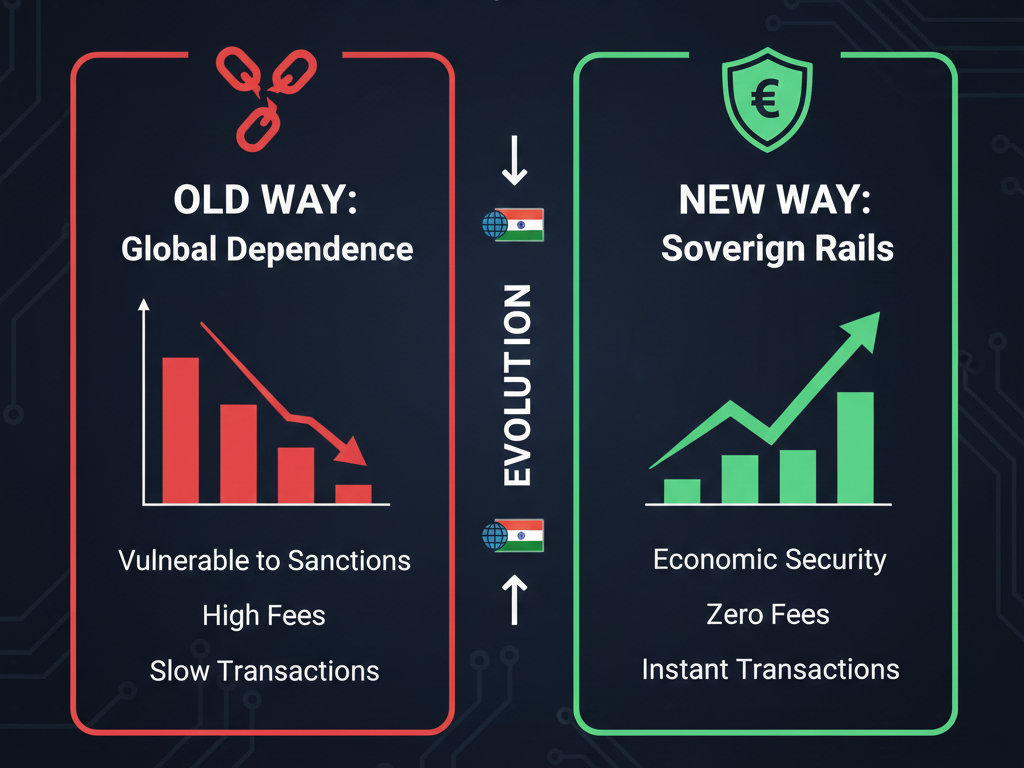

Why Every Nation Wants Their Own Money Rules

The journey to the top begins when a nation builds its own money path. At this stage, relying on a foreign payment infrastructure is a very big risk. These new tools act as a top guide for a country’s financial future. Specifically, a custom payment infrastructure ensures that a nation and its true worth stay safe. It is built to spark fast progress in every single trade deal. You should also know that a smart system offers more than just a way to pay. While a simple app just sends cash, a whole payment infrastructure guides the whole economy. Furthermore, it moves firms past the fear of being cut off from the world.

The True Influence of Digital Dollar and Yuan

As a nation’s tech grows, its influence spreads to other places. At this stage, the focus on a payment infrastructure builds a very strong bond with allies. This plan is specific to what a partner country likes and needs. For example, some might get a faster way to sell their goods abroad. The timing of these moves is very key for global success. Furthermore, a top leader handles all the tech and rules with ease. This ensures your trade plan is solid from the very first step. Such smart timing helps a country move toward a big global win. Indeed, a modern payment infrastructure reveals who is truly in charge today.

Protecting the Flow of Goods and Services

Data is the backbone of all smart trade and money success today. The way a country handles its payment infrastructure tracks how every dollar moves. This includes how users buy and sell items in a safe way. These facts help refine the path for every brand and firm in the land. Therefore, the system learns and grows over time to serve the people better. This data driven path ensures the best results for a whole nation. It also prevents any bad risks from hurting the economy. A smart payment infrastructure relies on real facts to win every single time. Your plan and focus are too important to risk at any step.

Conclusion and the New Map of World Trade

The future of global trade is too important to leave in the hands of others. Today, we see how a modern payment infrastructure changes who wins and who loses. This smart move helps a nation scale faster and stay much safer too. It turns simple tech into a real win for a whole region. You will see more growth and less stress for firms everywhere. Therefore, nations act now to secure their spot in the global market. Knowing the truth of quality tech lead leads to true success. It is the best way to ensure a bright future for many years. You will find that the right payment infrastructure makes all the difference in a trade war.

FAQs

1 How is a payment system a tool of power?

It lets a country control how money flows, which can help or hurt other nations.

2 Does this affect small businesses?

Yes, it makes it easier or harder for them to sell items to other countries.

3 Why is it called soft power?

Because it uses tech and money to lead rather than using a real army.

4 Is it safe for a country to use its own system?

Specifically, it is much safer because it stops other nations from blocking their trade.

5 Will this trend grow in the future?

Indeed, more nations are building their own tools to stay independent and strong.

Read More:

How a Trade Agreement Protects Your Brand in New Markets