Financial fragmentation can make traveling and trading between different nations very difficult because traditional currency exchange is often slow and expensive. However once you learn how Indonesia’s QRIS expansion connects Asian markets you will see a much smoother payment experience. I have analyzed how this cross border growth allows local businesses to accept international payments while seeing a massive boost in tourist spending.

The Problem With Traditional Currency Exchange

Many travelers still rely on physical cash or credit cards that charge very high fees for every international transaction. This approach creates a massive disconnect because users want a fast and digital way to pay for goods in a foreign country. You might feel frustrated when your local payment app fails to work the moment you cross a border. Traditional exchange methods are like carrying a heavy bag of coins and hoping every shop has the right change for you.

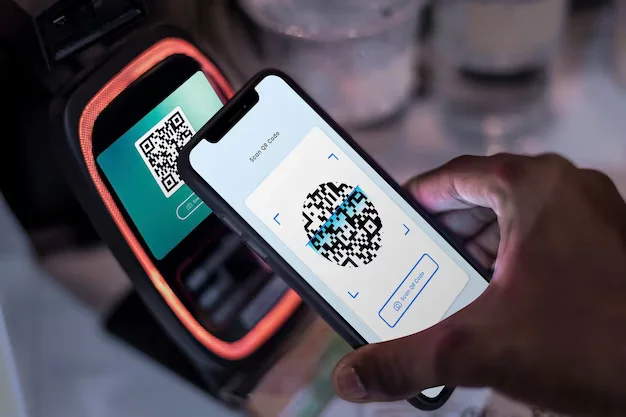

The solution lies in a unified digital system that works across different national boundaries instantly. Indonesia’s QRIS system allows a user to scan a single code to pay in their own currency while the merchant receives local funds. Once nations apply these interoperable standards you will see much higher trade efficiency across Asia. I have seen small vendors in Bali and Bangkok increase their sales by simply accepting digital payments from foreign visitors.

Strategy 1: Link Local QRIS to Regional Networks

Indonesia is actively connecting its national QR standard to other countries like Thailand, Malaysia, and Singapore. Specifically this link allows an Indonesian traveler to use their local banking app to pay for a meal in Kuala Lumpur. This integration removes the need for physical currency and lowers the cost for every person involved. Therefore you get a seamless experience that feels just like paying for something in your hometown.

Strategy 2: Implement Real Time Exchange Rates

Users love transparency because they want to know exactly how much they are spending in their own money. QRIS expansion uses real time rates to convert the price of a product at the exact moment of the scan. For example a shopper can see the cost in Rupiah even if the price tag is in Thai Baht. This level of detail builds immediate trust and encourages users to spend more during their travels.

Strategy 3: Optimize for Small Merchant Adoption

Many local businesses in Asia do not have expensive credit card machines because the fees are too high for their small margins. However QRIS is very cheap to implement since it only requires a printed code or a simple smartphone app. Because of this even the smallest street food stall can now accept international digital payments. This inclusion helps a wider range of local businesses benefit from the growth of regional tourism.

Strategy 4: Use QRIS to Drive Tourism Spending

A convenient payment system is a great way to encourage visitors to spend more money on local experiences. You can tell a traveler that they can pay for everything from a taxi ride to a luxury dinner using one single app. This creates a natural sense of ease that makes people more likely to choose Indonesia as their next destination. Consequently the local economy grows as digital friction disappears from the travel journey.

Strategy 5: Automate High Speed Settlement

Manual bank transfers between countries take a long time and often involve many different middlemen. However the QRIS cross border network uses advanced technology to settle transactions almost immediately. Your local business does not have to wait days to receive the funds from an international customer. Therefore you maintain a healthy cash flow and can restock your inventory without any delay.

Strategy 6: Provide Secure and Encrypted Transactions

Security is a primary concern for everyone who moves money across international borders today. QRIS uses high level encryption to ensure that every payment is safe from hackers and fraudulent activity. This ensures that both the customer and the merchant are protected during the digital handshake. Prompt and secure transactions help build a strong reputation for the Asian financial network as a whole.

Strategy 7: Collect Data for Regional Market Insights

Social proof and market data help you grow your business by showing you what your customers truly want. Indonesia’s central bank can use the data from QRIS to see which regions are seeing the most international spending. This allows the government to tailor its tourism and trade policies to match real world behavior. This simple step makes the entire regional economy much more responsive to changing user needs.

Strategy 8: Create a Seamless Bridge for Asian Trade

There are times when small businesses want to buy supplies from a neighboring country without opening a foreign bank account. You should use QRIS as a bridge that allows for easy business to business payments across Asia. This reduces friction and prevents small owners from having to deal with complex international wire transfers. A smooth payment bridge keeps the regional supply chain moving forward without any stops.

Strategy 9: Use Mobile Accessibility for Financial Inclusion

You want to make it as easy as possible for everyone to join the digital economy regardless of their location. Because many people in Asia use smartphones as their primary tool for internet access QRIS is the perfect solution. This saves people from the extra step of visiting a bank or carrying large amounts of cash. Therefore a single smartphone starts a financial journey that can lead directly to better economic health.

Strategy 10: Retarget International Shoppers Digitally

If a tourist buys from your shop using QRIS you can potentially use that connection to keep them engaged. For instance you can offer a digital loyalty card that stays in their mobile wallet for their next visit. This reminder should focus on the unique local experience your brand offers to every traveler. Remarketing with a personalized touch is a great way to win a repeat customer from across the globe.

Conclusion and Next Steps

If you follow the growth of this system you should soon see much better results for regional Asian trade. Please do not forget to let me know how you got on in the comments below. I am always interested in hearing your thoughts so tell me which part of this expansion you felt worked best for you.

FAQs

1 What is Indonesia’s QRIS expansion?

It is the growth of a unified QR payment standard that allows users to pay digitally across different Asian countries.

2 How does it help local Asian businesses?

It allows small merchants to accept international payments easily without expensive hardware or high fees.

3 Can I use QRIS in Thailand or Malaysia?

Yes, Indonesia has already established links with these countries to allow for cross border digital payments.

4 Is the QRIS system safe for travelers?

Yes, it uses advanced encryption and central bank oversight to ensure that every transaction is secure.

5 What is the first step for a business to accept QRIS?

The first step is to register with a participating bank or payment provider to receive your unique merchant QR code.

Also Read: Financial Fragmentation in a Multipolar World: Payment Guide