The Problem with Global Payment Monopolies

I’ve heard it a thousand times. A nation relies only on one foreign credit card firm. And yet, their local shops pay high fees. Usually, that is just a polite way of saying the country has lost its own power. Also, old bank moves take a long time. They involve too many middle men. If you build a new market on old tracks, you are building a ghost town.

In fact, a system where local tracks handle 80% of deals is worth much more. Furthermore, the biggest cost in 2026 is the lack of links between close nations. This happens when people must carry cash or pay high fees. This path creates a big gap. Because of this, users want a fast and easy way to pay.

The solution lies in a smart way to keep your money power. This turns a national rule into a solid sales tool. This isn’t just a tech shift. Instead, it is a big plan. This helps every person pay in a safe way. Once you use these rules, you will see your local market grow.

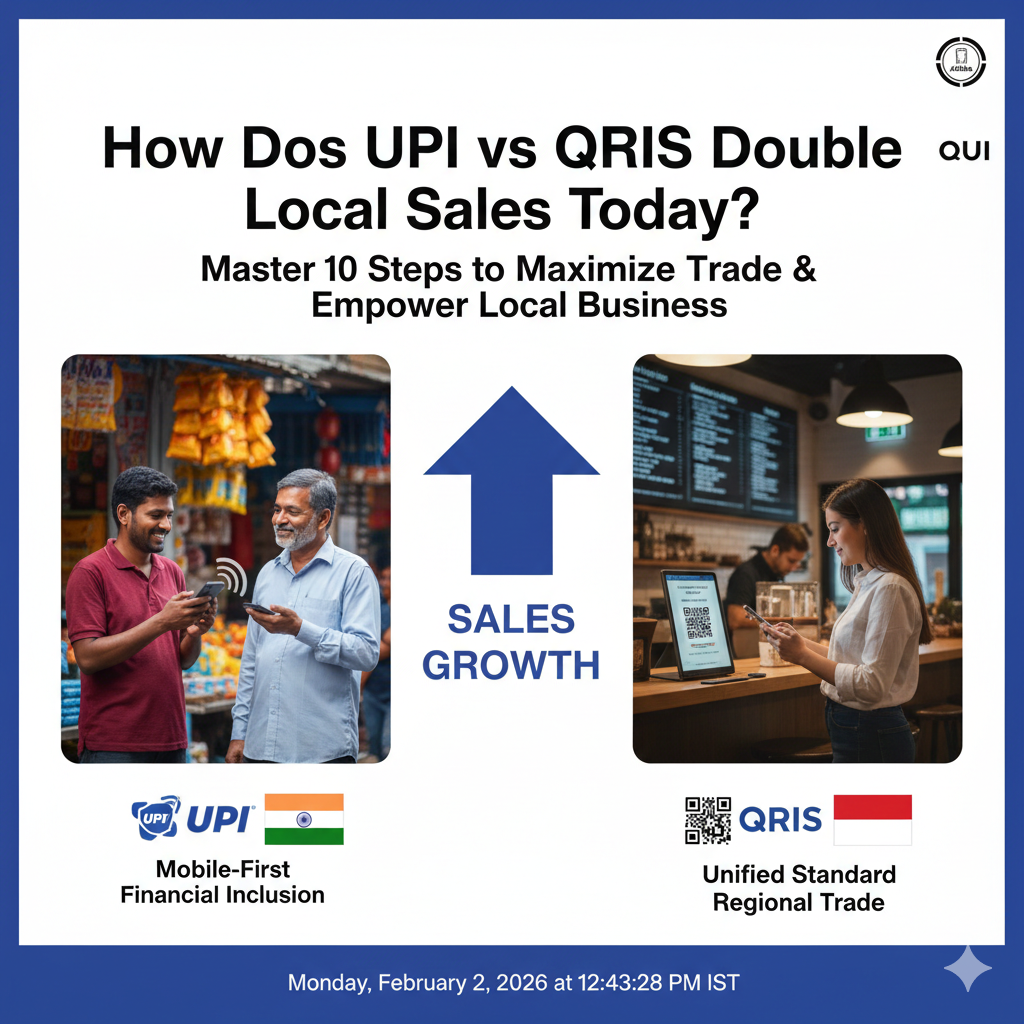

1. UPI: The Best Way to Join the Bank

If you aren’t looking at the UPI growth data, you are flying blind. Specifically, India’s UPI has won more of the market for three months in a row. You need to know why this tool works so well. For example, was it the low cost or the ease of use? Smart leaders use the UPI path to see how to reach far away areas. Then, they make mobile plans for their own folks.

Moreover, smart plans allow for a steady gain in the market. This is because they focus on a good user path. By using a top-tier plan, you help your local banks win. This leads to steady gains. It sounds simple. However, most lands are too busy guessing to look at the UPI success.

2. QRIS: Linking Asian Shops Through Scans

The move to regional QR tools is happening faster than we thought. While old tools are slow, QRIS adds cross-border links through one rule. These rules use logic to link many bank nets. These rules act like a smart helper for regional trade.

However, one-country tools are not enough for a big change. The most top-tier stage is a system for many lands. These nets handle tasks like live money swaps. These tools help many banks work as one. Consequently, they act as a smart brain for the whole Asian area.

3. Digital Euro: Keeping Europe’s Money Power

To build smart bank tools, you should not have to glue poor parts together. The Digital Euro aims to use one public coin. Specifically, this uses Europe’s strength to give safe answers to market moves. This means a person can travel with their full data ready to go.

Additionally, think of a case where your phone wallet knows your local spot. It uses safe data to help you buy things fast. This base ensures that your responses to global stress stay strong. Therefore, it stops the friction that slows down your best shops. It helps them finish big deals with fewer errors.

4. The 80/20 Rule for National Payments

If your land spends all its time on foreign nets, you have no time for local growth. You must follow an 80/20 rule. Thus, use local tracks to handle 80% of daily buys. This includes food or bus rides. This leaves the 20% of big global moves to top-tier firms.

Using fast moves helps shops stay on track without cash. AI can even set up fast replies based on simple talk. This allows your shops to work in a flow. They do not have to switch between many tools. This leads to much faster growth.

5. How to Track Your Money Success

If your bank talks about total sales but not local ownership, you need a new plan. Those are vanity marks that hide a weak spot. You can have many deals but no real power in the bank. To know if you are winning, you must track the “Dirty Four”:

- Local Ratio: First, how many of your deals stay on your own tracks?

- Shop Cost: Next, what is the total fee for every single scan?

- Fast Speed: Then, for every coin paid, how fast does it reach the bank?

- User Trust: Finally, when phone use grows, does your poor group get help?

Conclusion

How to win the money power race? It shifts from a secret to a system when you pick your goals well. You must set clear goals for the bank. Also, track gains with care using local data. Repeat this for 90 days. Then, growth becomes steady. This helps you spend your budget with trust.

Key Takeaways

- First, payment sovereignty helps a nation control its own money because it removes the need for foreign tools.

- Therefore, systems like UPI and QRIS serve as a bridge for trade and peace.

- Specifically, the Digital Euro wants to give a public way to pay across all of Europe.

- Furthermore, the QRIS model is growing fast to link Asian markets through easy scans.

- Consequently, these tools allow small shops to take international money while they boost local sales.

- In fact, India’s UPI has seen huge growth by making mobile phones the main way to join the bank.

- For instance, having one set of rules helps lower the cost of every deal for the user.

- Thus, using fast settlement stops the need for slow and very pricey old bank wires.

- In addition, using live exchange rates builds quick trust when you travel to other lands.

- Finally, keeping data local keeps your money safe and follows all your own laws.

FAQs

Q1: Can small lands afford their own pay tools?

Ans. Yes, tools like QRIS offer low-cost rules that work well for everyone.

Q2: How long before a new tool sees real growth?

Ans. Most systems see real gains and more users within 60 to 90 days of the start.

Q3: Is it better to focus on home use or foreign links?

Ans. Good local tracks work much better than relying on others in every test.

Q4: Will a Digital Euro take away my cash?

Ans. No, but it will act like a safe digital helper for all your phone buys.

Q5: What is the biggest risk for a big pay net?

Ans. Errors or bad data silos can be very bad, so make sure your tool has good backups.

Read More:

10 Ways QRIS Will Change How You Pay in Asia

Financial Fragmentation in a Multipolar World: Payment Guide