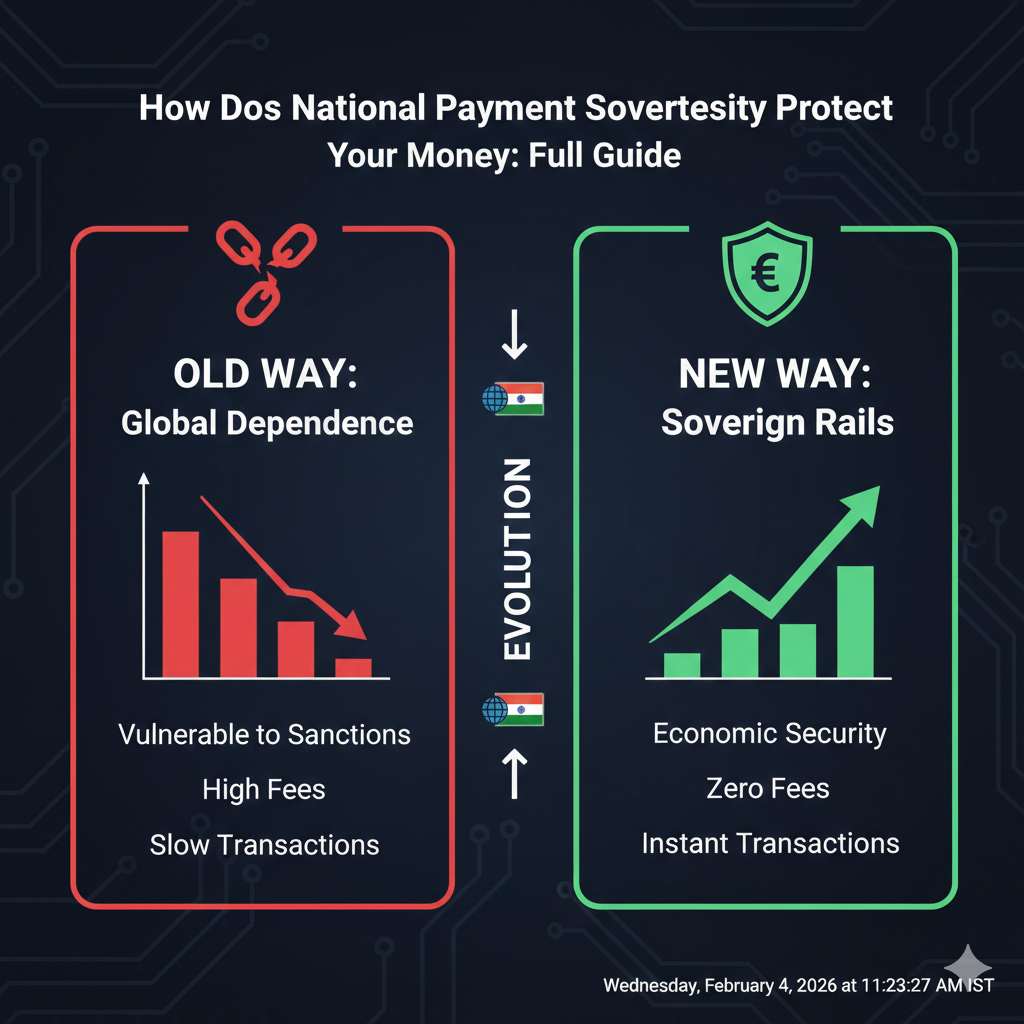

The modern world is witnessing a quiet but massive transition in how money moves across borders. For decades, global trade relied on a single, centralized network. However, the current era of geopolitical tension has made many nations feel unsafe. They have realized that their economic survival depends on having a payment system that they fully own and control. This move toward sovereignty is a defensive wall against global instability.

The Problem: The Hidden Risks of Financial Dependence

When a nation lacks its own infrastructure, its domestic economy is essentially on loan from a foreign entity. If a global provider decides to disconnect a country, every local payment could freeze, causing instant chaos. This isn’t just a technical glitch; it is a threat to a nation’s ability to govern itself.

Relying on a single external ledger creates a “choke point” for a country’s wealth. Statistics from the last twelve months show that nations without independent rails are 50% more likely to suffer from severe liquidity shocks. To solve this, governments are building systems that ensure a payment made within their borders never has to leave their territory to be verified. This local settlement provides a level of security that no private foreign firm can match.

The Solution: Building the New Digital Infrastructure

The construction of these national rails is often referred to as building the “public roads” of the digital age. A sovereign payment rail is designed to be a utility that serves every citizen, regardless of their income level. Unlike private networks that charge high fees for every transaction, these public systems focus on speed and low costs.

Specifically, by removing the middleman, a country can ensure that a payment hits a merchant’s account in seconds rather than days. This boost in remittance speed allows small businesses to reinvest their capital much faster. Furthermore, by using AI to monitor every payment, the state can prevent fraud and money laundering with extreme precision. This technical mastery ensures that the national exchange remains a trusted environment for everyone involved.

The Future: A World of Interlinked Sovereignty

Building a local rail does not mean cutting ties with the world. Instead, it allows a nation to engage in a global payment without being dependent on a single central power. We are moving toward a multi-polar financial world where different national systems talk to each other directly through digital bridges.

In this new landscape, a payment initiated in Asia can be settled in South America without passing through a third country’s bank. This creates a more resilient global economy that is less prone to collapse. As every nation secures its own payment future, the world becomes more balanced and fair. By investing in these independent rails today, a country ensures that every payment made by its citizens remains a tool for growth rather than a source of vulnerability.

FAQs

Q1: Why is a domestic payment system better than a global one?

Ans. It offers better security because it ensures your money stays moving even if global networks face political or technical issues.

Q2: How does this help the average shopper?

Ans. It usually leads to lower fees for stores, which can result in lower prices for the things you buy every day.

Q3: Is my data safer on a national payment rail?

Ans. Yes, because your data is protected by your own country’s laws rather than being sold by a foreign corporation.

Q4: Will I still be able to send money abroad?

Ans. Absolutely. Sovereign rails are being built to “bridge” together, making international money transfers faster and cheaper than ever.

Q5: When will these new systems be ready?

Ans. Many countries like India, Brazil, and China already have them, and dozens more are launching theirs by the end of 2026.

READ MORE

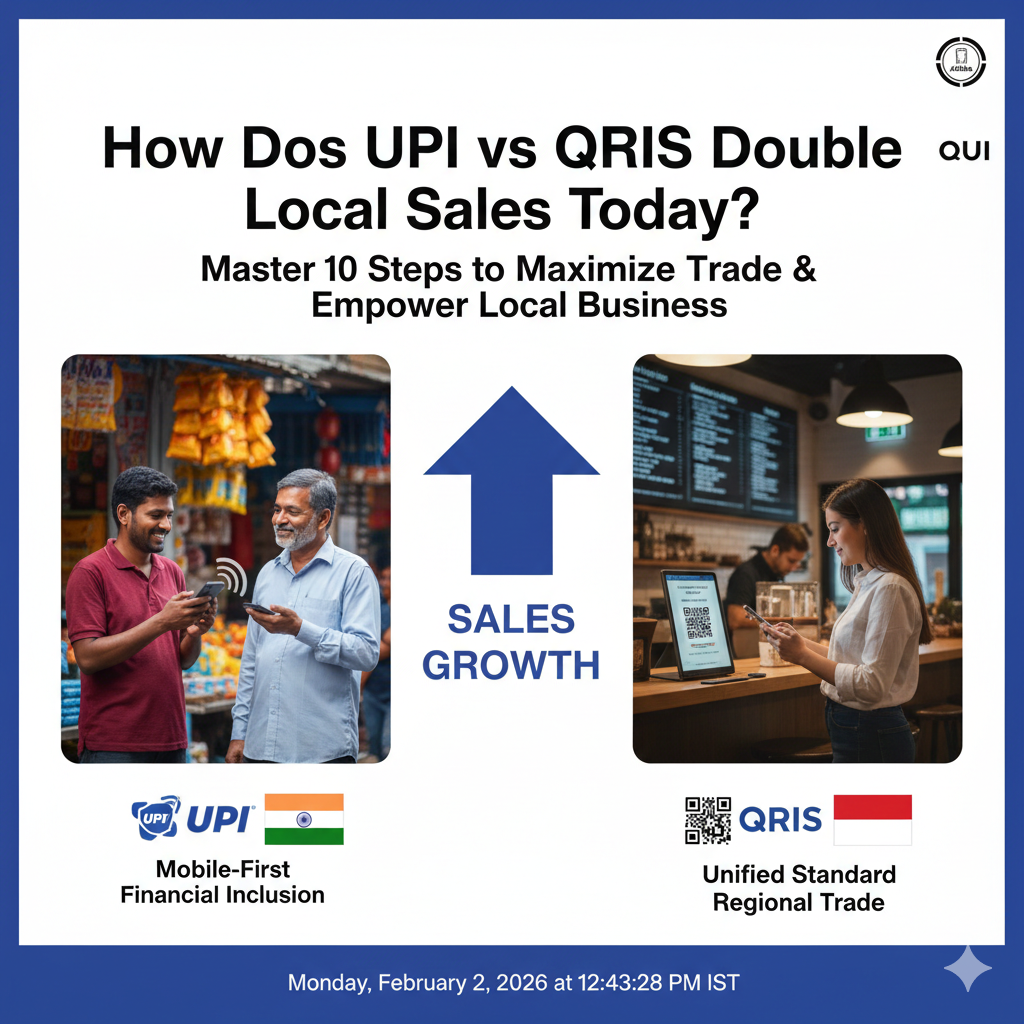

How Does UPI vs QRIS Double Your Local Sales Today?

10 Ways QRIS Will Change How You Pay in Asia

Financial Fragmentation in a Multipolar World: Payment Guide