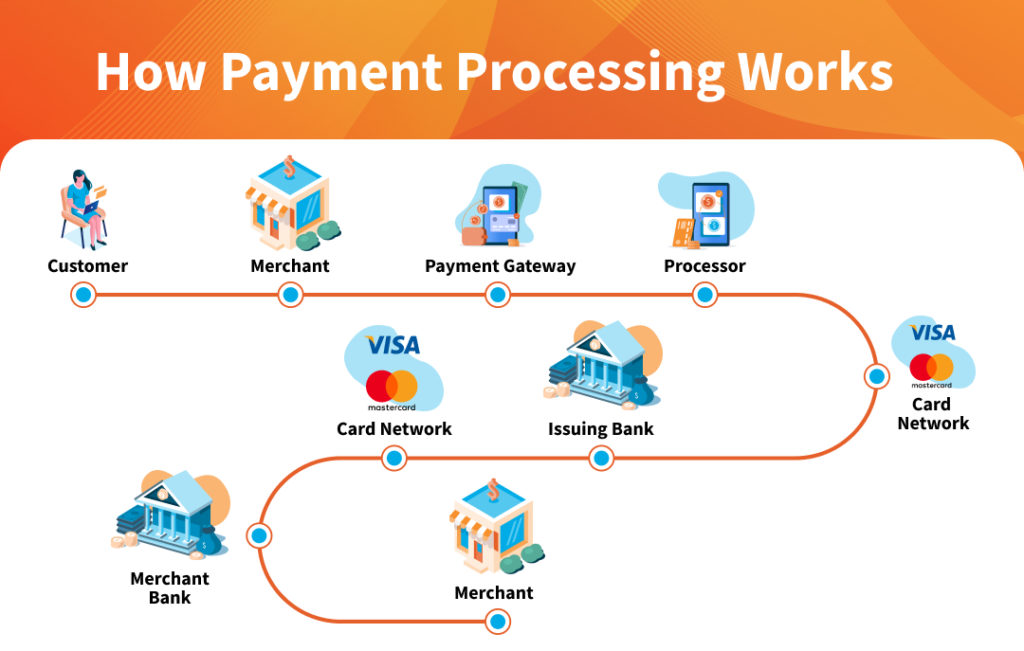

Selling a payment gateway is complex. Therefore, success depends on trust. You need users to sign up for your service. However, many potential users leave the page quickly. Truly, they see the sign-up page as a risk. This is where Landing Page Optimization (LPO) becomes vital. LPO helps you improve your sign-up pages.

Some companies focus only on their product features. They talk about low fees or fast processing. But, they forget the user experience. Consequently, users get confused. They hesitate to enter sensitive business data. Always remember, an optimized landing page simplifies the process. It builds massive trust. By focusing on a clear, friction-free sign-up path, you can turn more visitors into paying customers. This grows your user base faster. It also increases your market share.

The Payment Conversion Gap: Why Sign-Ups Fail

First, let’s understand why people abandon payment gateway sign-up pages. The main issue is the high perceived risk. Clients are trusting you with their money and data. Clearly, they need strong reassurance. Therefore, fixing the conversion gap means removing fear and building confidence.

Common Landing Page Blockers for Payment Sign-Ups

Mistakes on the sign-up page often kill conversions:

- High Risk Perception: The page does not look secure or professional. Users fear data leaks.

- Too Many Steps: The sign-up form asks for too much information upfront. Users feel overwhelmed.

- Unclear Value: The page does not immediately explain the benefit of signing up right now. Users delay the decision.

- Hidden Costs: Pricing and fee structures are confusing or hidden. Users lose trust instantly.

- Slow Speed: The page loads slowly, especially the form fields. This signals poor technology.

- Missing Trust Seals: There are no security badges or compliance logos visible. Users doubt your security claims.

Landing Page Optimization directly solves these trust and friction issues. It creates a seamless, safe environment for conversion.

What is LPO for Gateways? Your Trust Machine

So, what exactly is Landing Page Optimization (LPO) for a payment gateway? It is the continuous process of testing and improving your sign-up pages. The goal is to increase the number of visitors who complete the registration. Truly, LPO is about building a “trust machine.” It quickly convinces users that your service is safe, valuable, and easy to join.

Key Principles of an Optimized Gateway Sign-Up Page

Here are the four key principles of LPO for payment sign-ups:

- Security Focus: The page must look, feel, and be secure. This addresses the user’s primary fear.

- Friction Reduction: The form and the process must be as short and simple as possible.

- Benefit Clarity: The page must clearly state what the user gets immediately after signing up.

- Consistency: The page must exactly match the ad and the overall brand message.

Truly, LPO moves the focus from “selling features” to “securing a relationship.” It ensures the visitor feels confident enough to take the final step.

Pillar 1: Trust and Security Assurance

Trust is the single biggest factor for payment gateway sign-ups. Therefore, the first pillar of LPO is maximizing trust and security assurance. Clearly, if a user doubts your security for even a second, they will leave. Therefore, every part of the page must scream confidence.

Visual and Verifiable Trust Signals

Firstly, display security seals prominently. Use verifiable seals like PCI DSS compliance logos or SSL encryption badges. Place them near the form fields. Secondly, use social proof from big brands. Show logos of well-known clients who use your gateway. This uses their reputation to build yours.

Furthermore, use simple, reassuring language. State clearly, “Your data is secured with bank-level encryption.” Avoid confusing jargon about security standards. Also, add a clear Privacy Policy link right next to the sign-up button. This shows transparency. Lastly, feature customer testimonials that specifically mention reliability, security, and uptime. Truly, saturating your landing page with verifiable trust signals is the most effective way to overcome sign-up hesitation.

Pillar 2: Friction Reduction and Form Optimization

The second pillar focuses on removing friction from the sign-up process. Every extra field or unnecessary click lowers the conversion rate. Clearly, the goal is to make the process almost effortless. Therefore, optimizing the form is the most critical step here.

Simplifying the Sign-Up Journey

Firstly, use a multi-step form. Do not ask for everything on one long page. Start with simple fields like “Name” and “Email” on the first step. Save complex fields (like business tax ID) for later. Secondly, use smart field validation. The form should immediately correct common errors. This prevents frustration.

Furthermore, auto-fill known data. If the user clicks from a marketing email, pre-fill their email address. This saves them time. Also, minimize required fields. Ask only for the bare minimum needed to create the account. You can always gather more information later. Lastly, use progress indicators. If you must use a multi-step form, show the user where they are in the process (e.g., “Step 1 of 3”). This gives them a sense of control. Truly, by reducing the form length and simplifying the data entry, you remove major reasons for sign-up abandonment.

Pillar 3: Clarity and Consistent Call to Action (CTA)

The third pillar is ensuring absolute clarity in messaging and action. The user must know exactly what your gateway offers and what to do next. Clearly, a vague offer or a confusing button will kill the conversion. Therefore, optimize the messaging around the final conversion goal.

Driving Action with Precise Language

Firstly, use a highly specific headline. The headline must clearly state the offer, like “Start Accepting Payments Today: Sign Up Free.” Secondly, highlight the immediate benefit of signing up. Is it a free account? Is it an instant sandbox to test? State it clearly and boldly.

Furthermore, make the CTA button stand out and be specific. Use contrasting colors. Use action phrases like “Create My Free Account” or “Start My 30-Day Trial Now.” Avoid generic words like “Submit.” Also, ensure message match is perfect. The language and offer on the landing page must exactly match the ad they clicked. This prevents confusion. Lastly, ensure the CTA is placed strategically. Put the primary CTA above the fold. Repeat it near the form or the list of benefits. Truly, clarity in the offer and precision in the CTA leave no doubt for the user. They make the final sign-up decision easy.

Best Practices: Testing and Iterating for High Conversions

Landing Page Optimization is a continuous, data-driven process. It does not end after the first successful launch. You must always test and improve. Clearly, small, focused tests can lead to huge increases in sign-up rates. Therefore, adopt a rigorous A/B testing schedule.

The A/B Testing Mindset for Payment Gateways

Firstly, test the security elements. Test the placement of your security seals. Test the specific language you use to guarantee data safety. See which version makes users feel safer. Secondly, test the form length. Use A/B tests to see if a three-step form converts better than a two-step form. Find the sweet spot between lead quality and conversion volume.

Furthermore, test the benefit clarity. Test different bullet points that explain the gateway’s value. Focus on benefits like “instant setup” or “no monthly fee.” Also, track the bounce rate. If users leave quickly, the page is not loading fast enough. Track where users drop off the multi-step form. This shows you exactly where the friction is. Lastly, optimize for mobile first. Test the form’s usability on phones. Ensure the keyboard and fields work perfectly. Truly, by making testing a regular part of your marketing, you ensure your payment gateway sign-up page performs optimally in a highly competitive market.

Frequently Asked Questions (FAQs)

Q1: Is it better to ask for credit card details on the sign-up page?

No, it is usually not better. Asking for credit card details too early will drastically lower your conversion rate. Ask for payment details later in the process, only when the user is ready to activate the live processing service.

Q2: How important is page loading speed for sign-up conversions?

Page loading speed is extremely important. If your sign-up page takes more than three seconds to load, users will leave. A slow page also signals poor technology, which damages trust for a payment provider.

Q3: Should I remove all external links, even to my main website?

Yes, you should. The sign-up page should have one goal only: getting the sign-up. Remove the main navigation menu, social media links, and footer links. The only clickable links should be the CTA button and the Privacy Policy/Terms.

Q4: Which is generally more effective: a free trial or a free account?

A free account (with limits) is generally better for a gateway. This allows the user to explore the dashboard and test the setup without a time limit. This builds long-term engagement better than a trial that expires quickly.

Q5: How can I use content to support my sign-up page?

Use content to build trust before the sign-up page. Create blog posts or whitepapers on “Secure Payment Processing” or “PCI Compliance.” Use these as ads that lead to the sign-up page. This educates the user first.

Also Read: Fintech Content Strategy: How to Sell Payment Gateways?