Introduction

India is at the forefront of a digital revolution, with digital payments becoming an integral part of daily life. Over the past decade, the country has witnessed a paradigm shift from cash transactions to digital methods. This transformation has been driven by factors like increasing internet penetration, affordable smartphones, and government initiatives encouraging a cashless economy.

Payment gateways have emerged as the backbone of this digital payments ecosystem, enabling businesses to process online transactions securely and efficiently. Whether for e-commerce platforms, subscription-based services, or traditional retailers, payment gateways ensure seamless financial transactions, catering to the growing demand for convenience and security.

In this article, we explore the emerging trends shaping the future of payment gateways in India, highlight their growing importance, and discuss the role of Digitalpaymentguru.com in helping businesses choose the right payment gateway for their unique needs.

1. The Rise of Digital Payments in India

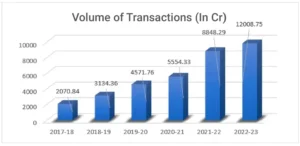

India’s digital payment ecosystem has witnessed remarkable growth, positioning the country as a global leader in financial technology. According to recent data, digital payment transactions exceeded 10 billion in a single month in 2023, a number expected to grow exponentially in the coming years.

This growth has been fueled by several factors:

Government Initiatives: Programs like the Digital India campaign, demonetization, and mandatory digital payment options for businesses have accelerated adoption.

Technological Advancements: UPI, mobile wallets, and real-time payment systems have revolutionized the way transactions are conducted.

COVID-19 Pandemic: The pandemic catalyzed the shift towards contactless payments, with businesses and consumers prioritizing safety and convenience.

The rapid adoption of digital payments highlights the critical role payment gateways play in modern commerce, ensuring businesses can meet the demands of tech-savvy consumers.

2. Emerging Trends in Payment Gateways in India

The payment gateway industry is evolving to keep pace with changing consumer preferences and technological advancements. Let’s explore the key trends that are shaping its future:

Unified Payments Interface (UPI) Revolution

UPI has become synonymous with digital payments in India. With over 12 billion transactions per month, UPI is the most widely used payment method. Its future developments include:

UPI Cross-Border Payments: Plans to enable international transactions will make UPI a global payment solution.

UPI Autopay: This feature simplifies subscription-based services by enabling recurring payments.

Voice-Activated UPI: Designed for non-tech-savvy users, especially in rural areas, this innovation uses voice commands to facilitate transactions.

Buy Now, Pay Later (BNPL) Expansion

BNPL services are gaining popularity, particularly among millennials and Gen Z consumers. Payment gateways integrating BNPL options provide customers with the flexibility to split payments, increasing conversion rates for businesses.

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are transforming payment gateways by enhancing security, efficiency, and personalization:

Fraud Detection: AI-powered systems analyze patterns to detect and prevent fraudulent activities.

Personalized Experiences: Payment recommendations tailored to user behavior enhance customer satisfaction.

Automated Processes: AI streamlines operations like chargeback management and customer support.

Tokenization for Data Security

With increasing cyber threats, tokenization is becoming essential. By replacing sensitive card details with unique tokens, payment gateways ensure compliance with RBI guidelines and provide enhanced security for transactions.

Blockchain Adoption

Blockchain technology is poised to revolutionize payment gateways by offering:

Transparency: Real-time transaction tracking and auditing.

Cost-Effectiveness: Eliminating intermediaries reduces transaction costs.

Security: Blockchain’s decentralized nature enhances data integrity and security.

Omnichannel Payment Solutions

Consumers now expect seamless payment experiences across multiple channels. Payment gateways are evolving to support omnichannel solutions, allowing businesses to accept payments online, in-store, and through mobile apps, creating a unified customer experience.

SME-Focused Payment Solutions

Small and Medium Enterprises (SMEs) are the backbone of India’s economy. Payment gateways are introducing affordable, easy-to-integrate solutions tailored for SMEs, enabling them to compete in the digital marketplace.

3. Challenges Facing Payment Gateways in India

Despite significant advancements, the payment gateway industry in India faces several challenges that need to be addressed:

Regulatory Compliance

Frequent changes in regulations, such as RBI’s guidelines on card tokenization, require payment gateway providers to continually adapt. While these regulations enhance security, implementing them can be resource-intensive.

Cybersecurity Threats

The rise of digital payments has also led to an increase in cybercrime. Ensuring robust security measures, such as encryption and multi-factor authentication, is essential to protect sensitive data.

Rural Penetration

Expanding digital payment infrastructure to rural areas remains a challenge due to limited internet connectivity and digital literacy. Payment gateways must develop solutions tailored to the unique needs of rural users.

High Transaction Costs

While payment gateways provide immense value, transaction fees can be a barrier for small businesses. Offering competitive pricing models is crucial to driving widespread adoption.

4. The Role of Digitalpaymentguru.com

Choosing the right payment gateway can take time and effort for businesses, given the plethora of options available. Digitalpaymentguru.com simplifies this process by offering:

Expert Advice: Tailored recommendations based on your business type, size, and requirements.

Comparison Tools: Comprehensive comparisons of features, fees, and integration capabilities of different payment gateways.

Technical Support: Assistance with setup, integration, and troubleshooting to ensure smooth operations.

Custom Solutions: Guidance for specific business models, such as e-commerce, subscription services, or brick-and-mortar stores.

By partnering with Digitalpaymentguru.com, businesses can save time, reduce costs, and ensure they select the best payment gateway for their needs.

5. Payment Gateways and India’s Digital Economy

Payment gateways are more than just transaction facilitators; they are enablers of India’s digital economy. Here’s how they contribute:

Boosting Financial Inclusion: By enabling digital payments in remote areas, gateways are helping bring unbanked populations into the formal economy.

Empowering Entrepreneurs: Affordable solutions make it easier for startups and SMEs to accept digital payments and scale their operations.

Driving Innovation: From instant refunds to AI-driven analytics, payment gateways empower businesses to enhance customer experiences.

Enhancing Customer Trust: Secure payment options build trust and encourage consumers to embrace digital transactions.

6. Looking Ahead: The Future of Payment Gateways in India

The future of payment gateways in India is bright, with several exciting developments on the horizon:

Global Integration: Expanding cross-border payment capabilities will enable Indian businesses to tap into international markets.

Voice and Biometric Payments: Innovations like voice-activated payments and biometric authentication will make transactions more accessible and secure.

Green Payments: As sustainability gains importance, payment gateways may introduce eco-friendly solutions, such as paperless receipts and carbon offset programs.

Conclusion

India’s payment gateway industry is poised for tremendous growth, driven by technological innovation, regulatory support, and a shift in consumer behavior. As digital payments become the norm, businesses must stay ahead of emerging trends to remain competitive.

Whether adopting UPI, leveraging AI for fraud prevention, or exploring Blockchain-powered solutions, businesses must choose a payment gateway that aligns with their goals. With Digitalpaymentguru.com as a trusted partner, companies can navigate the complexities of the payment gateway landscape and unlock new growth opportunities.